What is a Hammer Clause?

A hammer clause is a contractual provision within an insurance policy that allows the insurer to try to force their insured to settle a claim made against them or risk being responsible for all subsequent defense and judgment costs. Also known as a consent to settle clause, this is a common requirement in many legal malpractice insurance policies.

Here is a sample of how a hammer clause might read:

The Company shall also have the right to investigate any Claim and/or negotiate the settlement thereof, as it deems expedient, but the Company shall not commit the Insured to any settlement without their consent. If the Insured refuses to consent to any settlement recommended by the Company and elects to contest the Claim or continue any legal proceedings in connection with such Claim, then the liability of the Company for Damages and Claim Expenses shall not exceed the amount for which the Claim could have been settled, as well as the Claim Expenses incurred by the Company, or with the Company's consent, up to the date of such refusal.

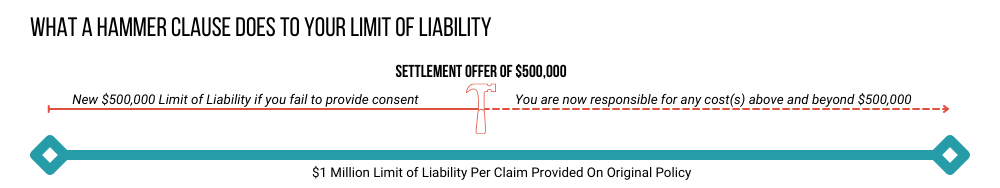

What does that really mean? This policy provision says that your insurance company can negotiate a settlement for a covered claim made against you. They also must seek your consent. However, if you refuse to provide consent, then your limit of liability for that claim is now effectively reduced to the amount of the settlement offer.

It's easy to understand why it's called a hammer clause, right? The insurance company can negotiate a settlement and limit their potential exposure while forcing you to settle a claim you might otherwise choose to defend. Other names for a hammer clause are blackmail clause or settlement cap provision.

Why does this matter to you?

Malpractice insurance is in place to provide you, as a policyholder, a coverage defense for any covered event. Two core components of your insurance policy are how your insurance company handles any settlement demand and what impact that settlement demand might have on your limit of liability available to pay for the cost of defense and any potential loss payment.

While an insurance company is in business to provide you coverage for covered events, many will also take the first opportunity possible to limit their costs, which only grow the longer it takes to defend the claim.

What if you don't want to settle? Or don't agree that the settlement offer is reasonable and fair? You may not have even made an error and the claim being made against you is frivolous. Regardless, a hammer clause allows the insurance company to try to force the decision to settle a claim made against you and gives the insurance company leverage against you.

Where can I find this clause in my LPL policy?

Every professional liability policy is written differently, with different definitions, policy terms, insuring agreements, and exclusions. However, hammer clause language is generally found in the defense and settlement section of your professional liability policy.

Are all hammer clauses the same?

All hammer clauses, by their nature, effectively reduce your per claim limit of liability if you withhold your consent to settle. However, you may find some policies that offer a coinsurance hammer clause. Instead of fully reducing your limit to the settlement amount, you may find versions that provide a split between what the insurer will cover moving forward vs. what you will be responsible for paying. Common coinsurance hammer clauses are 80/20, 70/30, and 50/50.

Do all LPL policies have hammer clauses?

All professional liability policies will have a settlement and consent to settle clause. Not all of them will be a hammer clause.

None of ALPS’s three policies* have a hammer clause. The ALPS Preferred and ALPS Premier policies have a provision that states that we will not settle a covered claim without your written consent. The ALPS Basic policy includes a provision that allows ALPS to settle the claim solely at its discretion.

*Specific policy language does apply. Please review to ensure actual coverage is understood

Related Insurance Definitions

Lawyers Professional Liability Insurance is Provided on a Claims Made and Reported Basis

Defense Within Limits (DWL) vs. Defense Outside Limits (DOL)

Limits of Liability (Per Claim vs. Aggregate)

Supplementary Payments or Sub-Limit Coverages