What's the Difference Between Defense Within Limits vs. Defense Outside Limits?

What are defense costs in a professional liability policy?

A limit of liability for your insurance policy is the maximum amount your insurance provider will pay for a covered claim. There will be a 'per claim' (or each claim) limit and an 'aggregate' limit of liability. The 'per claim' limit is the limit available for a single claim first made and first reported during your policy period. Your 'aggregate' limit is the maximum amount available for all claims during your policy period, without regard to the number of claims, claimants, or Insureds.

Choosing your limit of liability for your legal malpractice insurance policy should be an important part of your annual purchasing decision. It's obviously important to protect your firm with malpractice insurance, and it's equally important to make sure you have adequate protection for your firm’s risk profile.

Along with the limit of liability available, you must be aware of how the policy treats defense costs. Every attorney purchasing legal malpractice insurance should be aware of this critical policy feature and whether the attorney fees and costs incurred to defend a claim are “within the limit of liability” or “outside of or in addition to the limit of liability.”

Why does this matter to you?

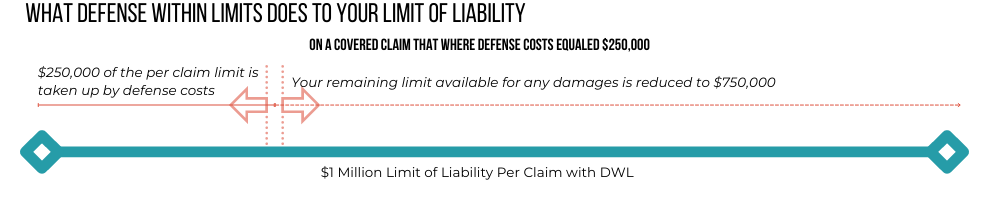

Under a “defense within limits” (DWL) policy, the defense costs incurred to defend a claim are applied against and reduce the limit of liability available to pay damages or loss for a covered claim under the policy. Thus, a DWL policy is commonly referred to as an “eroding limit” policy because the available insurance protection under the limit of liability erodes or is reduced as the claim is defended and defense costs are incurred.

Defending an LPLI claim is often difficult, time-consuming, and expensive. As the defense costs continue to mount, the limit of liability or insurance protection available to pay damages declines, and the insured attorney may find that the policy does not have enough remaining protection to pay the full extent of the damages or loss. In that unfortunate scenario, the attorney is faced with “uninsured damages or loss” in excess of the remaining limit of liability available to pay damages, thereby creating personal liability exposure for the attorney to satisfy the excess damages or loss.

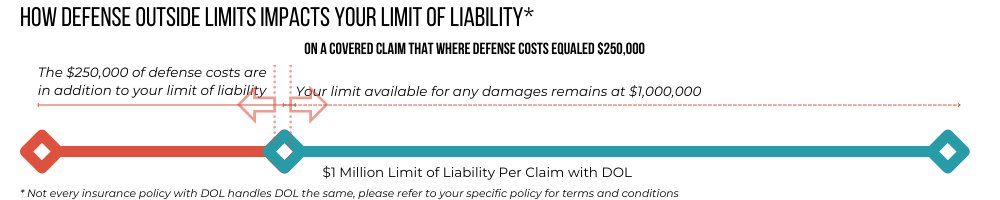

Under a DOL policy or “defense outside limits” policy, the defense costs incurred to defend a claim are outside of the limit of liability and are not applied against and do not reduce the limit of liability available to pay damages. As you can see, a DOL policy is clearly superior protection for a lawyer when compared to a DWL policy and the legal malpractice insurance cost for a DOL policy is higher.

Understanding this policy distinction is critically important because defense costs continue to rise.

Does a DOL Policy Cost More Than a DWL Policy?

Yes. With more total expense on the line for an insurance company, an LPLI policy with a Claim Expense Allowance is more expensive than a pure DWL policy without a Claim Expense Allowance. If you don’t believe you need a Claim Expense Allowance feature within your policy, then ALPS offers unique options for a true DWL policy that will reduce your legal malpractice insurance cost.

Are all DOL policies the same?

Insurance providers that offer DOL policies offer different flavors of claim expense allowances aimed at preventing you from having to pay out of pocket for claims and settlement

ALPS’s legal malpractice policies generally provide a substantial Claim Expense Allowance that is available up to $1 Million depending upon the limit of liability under the LPLI policy. It is rare that a Claim Expense Allowance would be exhausted, but under our LPLI policies, the limit of liability would begin to erode only after the Claim Expense Allowance is exhausted.

Can ALPS help make this easier?

Yes. Everything we do is aimed at making the insurance process as easy as possible and we take pride in making the complex feel simple. ALPS only offers lawyers' malpractice insurance and we have a team of dedicated insurance specialists ready to answer any question you have about coverage.

Whether it is understanding the coverage you have now. or helping you evaluate which of our three policy options is best for your firm, we are available to help you navigate a process that can feel overwhelming at times.

We are available to talk at (800) 367-2577, via email at customerservice@alpsinsurance.com, or chat. You can also schedule a call to talk when it's convenient for you. At ALPS we realize you're not just buying a policy, you're buying a promise.

Related Insurance Definitions

Extended Reporting Period (ERP) Endorsement

First Dollar Defense (FDD)

Prior Acts Coverage

Professional Services

Retroactive Coverage Date or Retroactive Date

Supplementary Payments or Sub-Limit Coverages