What Type of Policy is Lawyers' Professional Liability Insurance?

Does Malpractice Insurance Cost More Than Other Insurance?

Is There a Difference in How I Get My Legal Malpractice Insurance vs. My Home or Auto Insurance?

Are All Claims Made and Reported Policies the Same?

Can ALPS Help Make This Easier?

How Does an Extending Reporting Period (ERP) Endorsement Affect a Claims Made and Reported Policy?

Claims made vs. Occurrence Policy: What's the Difference?

What type of policy is Lawyers' Professional Liability Insurance?

An LPLI policy is quite different than the traditional insurance policy that you may purchase for your home, auto, or even health. These more traditional policies provide coverage on an “occurrence” basis while LPLI insurance provides coverage on a “claims made and reported” basis which is standard in professional liability insurance.

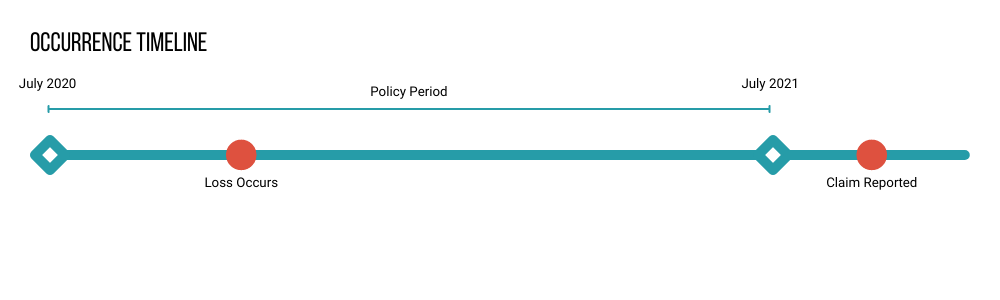

The fundamental difference is the event that triggers coverage under the policy. In a more traditional home or auto policy, for example, coverage is triggered when a covered event such as damage to your home or an auto accident “occurs” during the policy period, without regard to when the covered event is reported to the insurer, so long as the insurer is not prejudiced from a late reporting of the covered event.

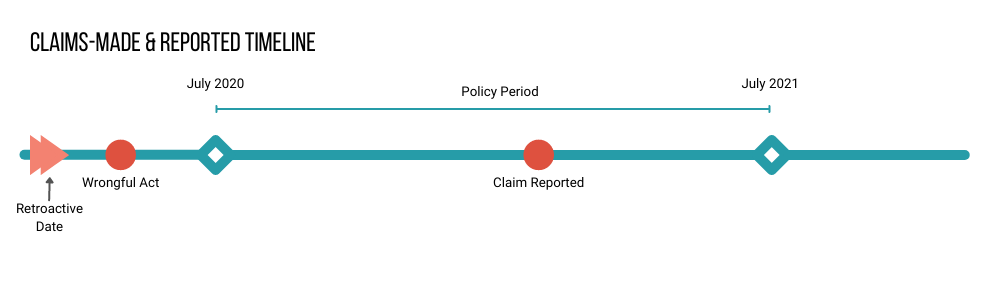

For a claims made and reported policy, coverage is triggered not when the Wrongful Act is made, but rather when the claim is reported to the insurance company.

Why does this matter to you?

At its core, insurance is designed to indemnify (or make whole) the policyholder for a covered event and requires the policyholder to report a claim to their insurance provider. The event from which a claim arises under a Lawyers' Professional Liability Insurance policy is generally an act, error, or omission in Professional Services. This is commonly referred to as a “Wrongful Act” in an LPLI policy.

In contrast to an “occurrence” based policy, where the "occurrence" of a covered event triggers coverage, the occurrence of a Wrongful Act during the policy period is not the event that triggers coverage under an LPLI policy. For example, the occurrence of a car accident is the event that triggers coverage for your auto policy. You will then make a claim against the policy in place on the date of the car accident.

However, malpractice insurance coverage is triggered only when a covered claim that arises from a covered Wrongful Act is “first made against the Insured and first reported to the Insurer” during the policy period. This is true even if the covered Wrongful Act did not occur during the policy period, so long as the covered Wrongful Act occurred on or after the Retroactive Coverage Date specified in the policy.

This distinction is critically important because most mistakes that a lawyer makes are not discovered immediately, and most claims against a lawyer for legal malpractice are not made against a lawyer until well after the actual mistake or error is made.

Does Lawyers' Malpractice Insurance Cost More Than Other Insurance?

Many attorneys can expect to pay between $2500 - $3500 for a comprehensive policy with commonly accepted limits. However, a solo attorney can purchase a low-limit policy for as low as $500 and certain attorneys can pay as much as $6500. To learn more about what goes into the cost of your lawyers' malpractice insurance, visit our page on the True Cost of Legal Malpractice Insurance.

As a comparison, an auto policy can range between $1500 - $3000 depending on a driver's profile. Similarly, the average cost of home owner's insurance nationwide is ~$1600 but can vary as low as $500 and as much as $3000 depending on location.

Is there a difference in how I get my Legal Malpractice Insurance vs. my Home or Auto Insurance?

In both types of insurance policies, you have a choice in how you purchase insurance. You can buy through a broker or insurance agent or you can purchase directly from the insurance company. An agent or broker may represent only one carrier or they may provide you a choice of insurance providers. One thing they all have in common is that they are independent of that company and not employed directly by the insurance provider.

With direct providers, like Geico (home, auto, renters, etc.) or ALPS (legal malpractice insurance), you will work directly with employees of the insurance company. At ALPS we believe that being a direct insurance provider is better for you. You've worked hard to build a successful practice. Don't you want to deal directly with the company that's responsible for protecting your firm?

Are all claims made and reported policies the same?

As opposed to homeowners and auto insurance policies, which are relatively standard across the industry, claims made and reported policies can vary greatly in ways that can directly impact the coverage you receive. Policy differences can impact if/how the cost of defending your claim affects your limit(s) of liability available to pay for a covered loss. They can also differ in offering additional, or supplementary, coverages that can add significant value to your policy. One of the most important differences between policies is what is (and is not) considered covered professional services under the policy.

When reading their policy, many attorneys only look at the first section of their policy to understand their coverage, or what their insurance company is agreeing to provide. However, many key differences in coverage can lie within the definitions of a policy as well as the exclusions. It is important for you to carefully educate yourself about what your policy does, and does not, provide.

For further information, check out the ALPS Glossary for common insurance terms and their definitions.

Can ALPS help make this easier?

Yes. Everything we do is aimed at making the insurance process as easy as possible and we thrive on making the complex feel simple. ALPS only offers lawyers' malpractice insurance and we have a team of dedicated insurance specialists ready to answer any question you have about coverage.

Whether it is understanding the coverage you have now. or helping you evaluate which of our three policy options is best for your firm, we are available to help you navigate a process that can feel overwhelming at times.

We are available to talk at (800) 367-2577, via email at customerservice@alpsinsurance.com, or chat. You can also schedule a call to talk when it's convenient for you. At ALPS we realize you're not just buying a policy, you're buying a promise.

How does an Extending Reporting Period (ERP) Endorsement affect a claims made and reported policy

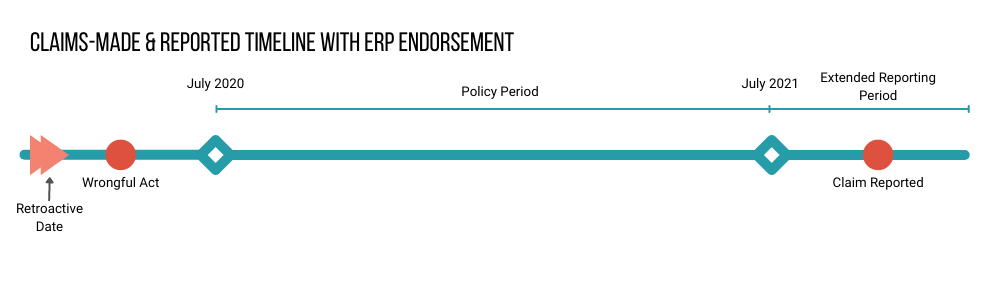

An ERP is one of the more confusing industry terms, yet one of the more important concepts to understand. An ERP extends the timeframe in which an attorney can report a claim and have it covered under an otherwise expired policy. By their very nature occurrence policies do not have, or even need, an extended reporting period endorsement.

However, because lawyers frequently need protection for their professional services beyond the expiration date of the LPLI policy, ERPs can provide peace of mind through the ability to report a claim and have it covered when a policy is no longer in force.

Let's re-look at the example above. Remember that malpractice insurance coverage is triggered only when a covered claim that arises from a covered Wrongful Act is “first made against the Insured and first reported to the Insurer” during the policy period. The Wrongful Act can be reported with an ERP during the policy period or any Extended Reporting Period.

An extremely important note is that an ERP does not extend coverage for Professional Services rendered after the expiration of the existing LPLI policy. It only extends the time during which a claim may be reported to the Insurer for a claim arising from Professional Services rendered prior to the policy's expiration date.